Updated 12/15/2022. Originally published 2/25/2021.

What is Hardware as a Service (HaaS)?

Hardware as a Service – or HaaS – is a proven business model for MSPs and Technology Solution Providers and an important piece to a complete As-A-Service model. It is a simple concept. You sell a total solution to your customer. They get the hardware, software, installation, training, consulting and, of course, it all comes fully managed in a single monthly payment.

Many times, Managed Service Providers buy and own the hardware, and rent it to the client along with their Service Level Agreement (SLA), which the MSP bills and collects monthly.

This model gives Solution Providers the ability to increase margins on hardware and service, standardize their customer base, and improve recurring revenue. HaaS also has the unique ability to cripple the cash flow of a Managed Service Provider if not well-managed.

HaaS – Funded with Cash Flow

In this HaaS model, the Solution Provider is using their own cash reserves to purchase the equipment or hardware, and then include it in their Service Level Agreement for a fee. The Solution Provider will typically break even in 12 to 18 months on the initial investment, and the remaining payments collected are all margin.

Use Case

This model works best when the MSP is only offering a single piece of hardware to small clients. For example, if a Solution Provider is offering their Backup Disaster Recovery (BDR) device as a service on their Managed Services offering. This is a relatively small investment and is lower risk for the Solution Provider.

Benefits

There are a number of benefits to this model including:

- No involvement of a third-party with your client

- No need to change your processes

- You have a strong return after the breakeven point

- You retain full control over the process

- You have an easy refresh cycle

Considerations

The Solution Provider should fully understand these considerations:

- You act as the bank

- The more HaaS you do in this model, the more cash you tie up

- This model makes your initial cash flow negative

- You are responsible if the customer doesn’t pay or goes out of business.

HaaS – Funded with Financing

In this model, the Solution Provider utilizes a bank line, financing, or even credit cards to purchase the assets, then rents them to customers as part of the Service Level Agreement. Like HaaS funded with cash flow, the Solution Provider will break even in 12 to 18 months and collect the remaining payments as margin.

Use Case

As in HaaS funded with cash flow above, this model works best with a specific product, though using the resources of a financial institution, some Solution Providers expand their Hardware as a Service to a full suite of product offerings.

Benefits

There are benefits to the Solution Provider by using a financing source to fund their HaaS offering including:

- No third-party involvement with your clients.

- It is easy to adapt your process to accommodate funding needs.

- You are cash flow positive at the start of the project.

- You have an easy refresh cycle.

Considerations

Here are some considerations if you are thinking about using financing to fund your HaaS offering:

- The bank or funding source may require paperwork or other upfront processes.

- The more you do the more of your money you tie up in customer assets.

- Your risk and debt load increase with the project size and/or the term.

- You are financial liable if the customer doesn’t pay or goes out of business.

White Label Manufacturer HaaS

This is becoming the most widely available option as manufacturers of the technology you sell enter the As-A-Service space and offer HaaS programs. In this model, the manufacture uses their cash to fund the purchase upfront and bills the Solution Provider each month. Then the MSP marks up their monthly payment and includes it in their Service Level Agreement.

Use Case

These manufacturer programs are ideal for Solution Providers who want to limit the use of their own cash or funding sources, but only want to offer a single product. It is simple in that there is no impact to the balance sheet, but there are risks to a program like this.

Benefits

Here are some of the top benefits to a manufacturer program:

- The equipment manufacturer makes the upfront investment.

- This is a simple way to get started with HaaS.

- You are cash flow positive at the beginning of the project.

- You typically maintain control over the product.

- You have an easy refresh cycle.

Considerations

While the manufacturer program has many benefits, here are some considerations:

- You may bear the risk if the customer doesn’t make their payment or goes out of business.

- You are limited to only the products the manufacturer makes.

- Vendors and manufacturers often change their programs and offerings.

Leasing the Hardware with 3rd Party Financing

In a white label HaaS program with 3rd party financing, we are talking about what GreatAmerica does. The Solution Provider uses a finance company to lease or rent the hardware to the customer alongside any supporting services.

Related: The Finance Process in Seven Steps

Use Case

One of the biggest benefits of a program utilizing a 3rd party financing company like GreatAmerica, is that Solution Providers are able to expand their offering by extending the terms and risks out to each of their clients, as opposed to the MSP taking on all the risk. This is a strong alternative for a technology company who has already mastered an As-A-Service model with their own money, but no longer wants to continue funding Hardware as a Service or have reached their funding limits.

Benefits

The major benefits of 3rd party white label financed HaaS are:

- The finance company makes the upfront investment.

- You are cash flow positive at the outset of the transaction.

- You can finance your full suite of products.

- The project costs, labor, and margin can be included in the upfront funding.

- You have an easy refresh cycle.

Considerations

As with all offerings, there are things to consider with this model:

- There is additional quoting and credit approvals involved for you and your clients.

- Your customer could receive multiple invoices – one for the equipment and another for your services.

- The finance company you use owns the contract.

Traditional 3rd Party Leasing VS. GreatAmerica Hardware as a Rental®

The GreatAmerica Hardware as a Service offering, called Hardware as a Rental (HaaR®), is similar to the 3rd party financing option, but with a few twists that make it more friendly for Managed Service Providers.

This blog details the primary differences between HaaR, HaaS, and traditional leasing, but there are a few important things to consider:

- You can offer a single invoice/payment option to customers by having GreatAmerica include your Managed Services fees on the invoice we send.

- Unlike a lease, your customer doesn’t have the option to own the technology at the end of the agreement.

- You can set up your quote tool to provide monthly payment options with a few clicks, and display it on the proposal as a single monthly payment.

WATCH: How Hardware as a Rental® Works

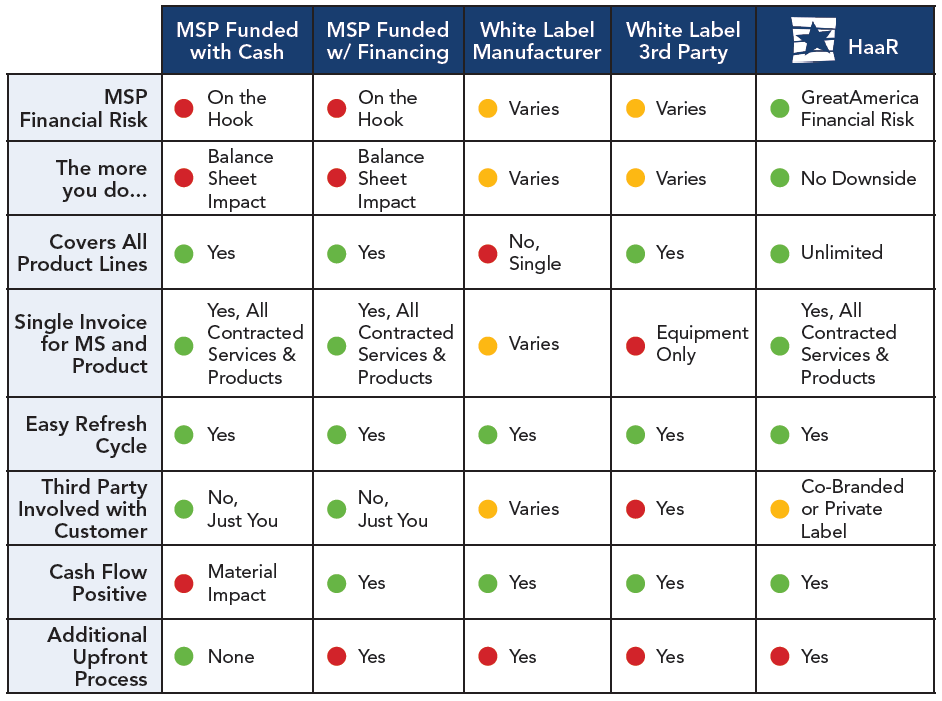

Considerations for each Hardware as a Service Model

During a 2019 webcast with Paul Dippell of Service Leadership, we shared this comprehensive chart. Here you can compare how each of the options we described above stacks up in one of eight categories.

Enjoy this content? Download this PDF to have and share.

GreatAmerica

GreatAmerica is the largest independent, family-owned national commercial equipment finance company in the U.S. and is dedicated to helping manufacturers, vendors, and dealers be more successful and keep their customers for a lifetime. GreatAmerica was established in Cedar Rapids, Iowa in 1992 and now has offices in Iowa, Georgia, Minnesota, and Illinois. In addition to financing, GreatAmerica offers innovative non-financial services to help our customers grow.