When we asked tech buyers how they pay for their equipment they told us they prefer to lease or rent their technology. As more of your clients ask for a monthly payment option, you have decisions to make on which method to provide. A GreatAmerica financial solution is one option.

Unfortunately, there is a lot of mystery around technology financing; and despite the fact that technology buyers prefer a monthly payment for equipment, many technology Solution Providers still aren’t offering a lease or rental. One of the biggest questions we get is around pricing and fees for financing, so we provided some answers:

How do you calculate a monthly payment for a lease?

We use a table of lease factors, sometimes referred to as a lease rate. If you know the equipment price, you multiply it by the rate factor to get your monthly payment: Equipment Cost x Lease Rate = Monthly Payment. You can also go about the calculation backwards if you know what the monthly payment should be. That calculation is: Monthly Payment / Lease Rate = Equipment Cost.

Sound like too much work? We thought so, too. That is why we have built calculators to help make the process quick and painless. SnappShot is our mobile app that calculates monthly payments and allows your sales team to submit applications on the road. The GreatAmerica portal, info-zone.com, also has a pricing calculator that allows you to create a proposal.

Best yet, the monthly payment calculator integrates with the tools you already use. We’ve partnered with companies like ConnectWise Sell, Salesforce, QuoteWerks, Tigerpaw, ChannelOnline, Solutions360 and D-Tools to enable you to quote payments with a few simple clicks.

See all our integrations and schedule a demo.

How do finance companies calculate lease rates?

There are multiple factors that go into calculating lease rates. The following are typical components our financial analysts use to build appropriate lease rates: equipment/software type, lease type, transaction size, term, useful life of equipment/software, cost of sales, and cost of operations. Finance companies like GreatAmerica typically borrow money, and we call that cost of funds. Then the items mentioned above are factored in to calculate the lease rate.

What additional fees do customers incur during the life of a lease?

The fees charged throughout the agreement depend on the finance company. Many companies will charge a lower lease rate, but make up for it over the term of the agreement in fees, while other companies charge a higher rate and don’t nickel-and-dime your customers throughout the lease term. Below are some fees your customers should watch for and understand before signing their agreement:

Origination Fee

Most leasing companies will charge an origination fee (sometimes referred to a documentation fee) to cover costs associated with the credit review and filing fees. The origination fee is not intended to reflect a reimbursement of specific charges for the individual transaction as those costs will vary from transaction to transaction, while this is a fixed fee. We’ve seen it range from $100-$500.

Interim Rent

Interim rent is sometimes charged on leases to make up for the time between when the equipment is installed in the customer’s location and the time the lease agreement begins. For example, the equipment is installed on January 7th, but the lease payments will be due on the 15th of each month, there are 8 extra days the customer had the equipment but isn’t paying for it. That is how many leasing companies view the need for interim rent. In this example, if the monthly payment is $2,500, eight days of interim rent would come out to more than $600 that your customer didn’t budget for. Not all leases include interim rent, so it is something to consider whether you and your customer want this as part of the leasing arrangement.

The Insurance Coverage Requirement

Property coverage of the collateral being financed is very important for both the customer and for GreatAmerica. If and when the unexpected happens, having insurance coverage provides comfort for all affected parties. Within the first month following contract commencement, your customer will receive an insurance letter outlining the cost to move forward with insurance coverage through a third-party insurance company. If your customer has their own property coverage for the leased equipment through a different provider, the proof of insurance requirements are outlined in detail in the letter.

Property Tax Administration Fee

In many states and counties, businesses must pay property tax on equipment purchases. The property tax must still be filed and paid when equipment is acquired on some agreements. In some cases, like $1 out leases, the legal owner of the equipment is the end-user lessee, and they are responsible for filing and paying the property taxes. In other lease agreements, like Fair Market Value leases, the leasing company is viewed as the owner of the equipment and the burden is on them to file and bill the property taxes.

What customers should be aware of, is that many times the leasing company will ask the customer reimburse them for the property taxes paid. Some leasing companies charge an additional fee for the administrative burden of filing, paying and billing the customer for the property tax. That fee can be charged every year, which could add up to several hundred dollars.

Payment-Related Fees

As with most bills you get, leases are subject to late fees, check by phone fees and/or returned check fees. With these fees, you’ll want to keep an eye on whether those fees are reasonable, since they can range quite a bit. For example, we’ve seen late fees range from 1.5% - 15% of the amount due.

State Specific Fees

Depending on the state the equipment is leased in, there are a few states that have additional fees that we haven’t covered here. For example, Florida and North Carolina have documentation stamp fees and Tennessee has a local option tax. These are not financing company fees and the money is sent straight to the state, county, etc.

End of Term Costs

Once the agreement reaches the end of the agreement, there are additional charges and fees you will want to be aware of.

Residuals

At the end of the term on a Fair Market Value lease, customers have the option to purchase the equipment. The amount paid to own the equipment is typically referred to as a residual. This residual is also a way some leasing companies drive their lease rate down, by having a high residual at the end of the agreement. This is sometimes referred to as a balloon payment. Understanding what your customer can expect for a residual will ensure there aren’t surprises at the end of term.

Restock Fees

At the end of a Fair Market Value or Rental agreement, your customer typically has the option to return the equipment on lease. A restock fee is charged by a leasing company as a way to recuperate the costs of selling the equipment to a remarketer. An example is charging the customer a fee of two additional lease payments if they choose to return the equipment.

Evergreen Clause or Locked-In Renewal

The “evergreen clause” or locked-in renewal can also lead to some unexpected costs at the end of the original lease term. A locked in renewal forces your customer into additional payments past the agreed-upon lease term. Sometimes it is for a couple months, but some companies will lock customers into a year or more of mandatory payments.

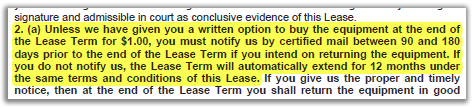

The clause looks pretty pedestrian, but can put a hurtin’ on your customers pretty quickly. Here’s what just one flavor of an evergreen clause we pulled from a competitor’s lease agreement:

NOTE: This is NOT a GreatAmerica lease agreement.

In the example above, the customer would have to notify the lease company between 90 and 180 days by certified mail that they planned on returning the equipment. Otherwise, if they miss the 90 to 180 day window, they would be required to make an additional 12 months of payments. Think about it this way: in order to notify the leasing company in this example, they would need to mark on their calendar at the beginning of the lease to remember when they needed to notify the leasing company.

These renewals can range from month-to-month, to 90 day renewals, all the way up to a full year’s worth of payments.

Finding a Trusted Leasing Partner

Leasing and financing can seem complex, but if you select a trusted leasing company, the process can be quite smooth. Need help evaluating a leasing company? Start by asking these seven questions of your provider to better understand how they’ll treat you and your customers.

GreatAmerica

GreatAmerica Financial Services® is the largest family-owned national commercial equipment finance company in the United States. With $3.5+ billion in assets and life-to-date finance originations of $16.1 billion, GreatAmerica is dedicated to helping manufacturers, distributors, resellers, and franchisees be more successful and keep their customers for a lifetime. GreatAmerica offers innovative, complementary services in addition to financing. Established in Cedar Rapids, Iowa in 1992, GreatAmerica also maintains offices in Des Moines, IA, Marshall, MN, Milton, GA, and Northbrook, IL. The company is deeply rooted in the communities where it has offices, contributing more than $1.1 million annually through its Donor Advised and Employee Advised Funds—empowering team members to guide charitable giving and make a meaningful difference where they live and work.